Peter Miller

Real Estate and Remodeling Trends

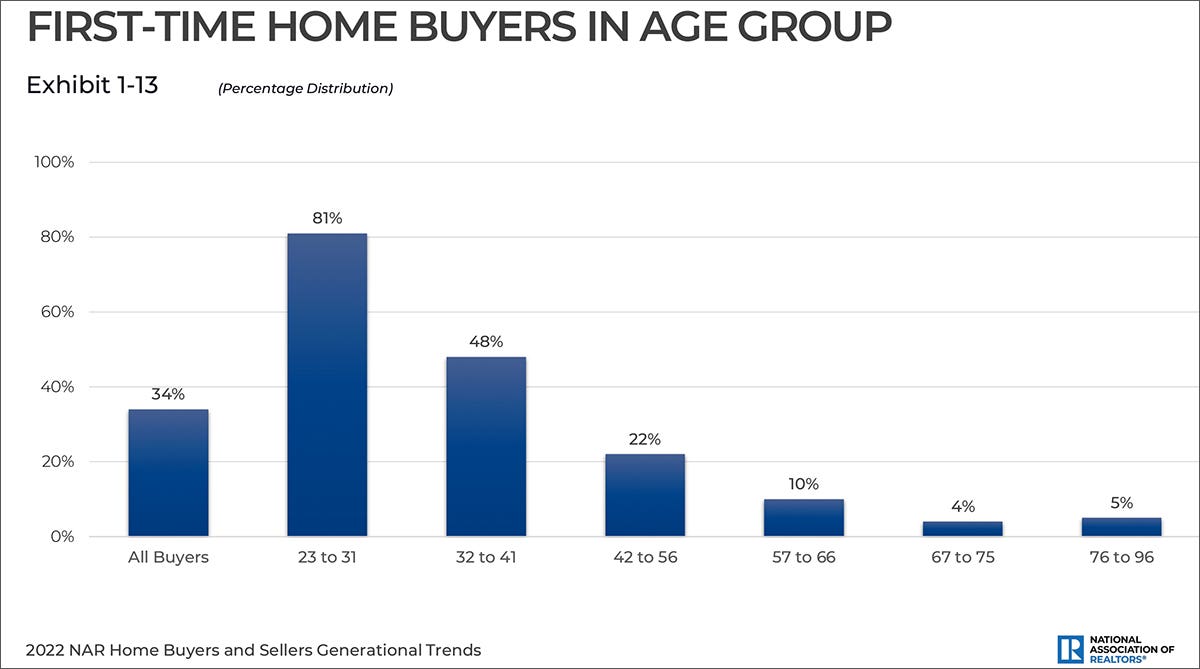

First-time homebuyers are older now than they were a year ago. In 2022 the typical first-time home buyer was 36 years old, a year prior, 33 years old. And likely because of rising mortgage rates this year, first time home buyers represent 26 per cent of the home-buying market, down from 34 per cent in 2021. The typical repeat buyer was 59 years old this year. Both are “all-time highs,” according to the research.

Another all time high: the number of first-time home buyers who are either unmarried or “other household compositions.” Fourteen percent of buyers purchased a multi-generational home to take care of aging parents or because their grown-up children are moving back home.

When people bought a house and moved, they moved further, according to the NAR. The median distance between their existing home and the one they bought was 50 miles, up from 15 miles in prior years. More people can work remotely and move to small towns and rural country where housing is more affordable.

Twenty-eight percent of home buyers surveyed paid more than the asking price for their house! It has been a frothy market where good old houses in desirable neighborhoods have twelve bidders offering 50% over asking price. As one Washington DC realtor told me, “This market is all cash, no contingency.”

Homeowners are staying put. It used to be that people lived in their house an average six years before moving or trading up. Now, it’s 10 years. For the last 15-20 years there has been an “aging in place” trend where baby boomers have upgraded their homes to stay put as they grow older. But now, even younger buyers are staying in their homes longer.

Increasing home appreciation has given homeowners more home equity which is a driver of remodeling market growth. The R&R market will grow another 6.5% in 2023, down from 16% growth in 2022. The remodeling market is now an estimated $450 billion. As mortgage rates rise, remodeling an existing house looks like a better option than buying something new and trading a low rate for a higher one. Hurricane repair and mitigation is another strong driver of remodeling growth. According to the National Association of Realtors, home resales number 4.7 million. We know that remodeling occurs most frequently when houses change hands.

Most of the builders and architects I talk to say, “We’re busy having a record year.” Some of it is working through their backlog but much of it is the confluence of demand from 40-year olds and 70-year olds, two bulging population cohorts who buy, build and remodel houses. At the high end of the market, the incidence of cash purchases is way up.

In some markets around the country there was a lull in commercial building and renovation while the Federal Reserve signaled, then raised interest rates. Investors don’t like unpredictability. But now that it is what it is, more projects are starting back up, which makes designers and estimators busy again. The multifamily market remains strong with over 500,000 new units in 2022. With fewer young buyers qualifying for higher mortgages, the rental market should remain strong.

Warren Buffett says, “when the tide goes out, we see who’s swimming without a bathing suit.” Absent the covid bubble and PPP subsidies, badly managed companies will suffer amidst what feels like a self-fulfilling prophecy: talking ourselves into a recession. Well managed companies have less backlog but new business too, business that carries them well into next year. At the high-end of the market, the stock market is a better barometer than the production housing market.

And the existing house market, homes in desirable neighborhoods, the old house market, is the best barometer of all. According to the NAR, 88% of home buyers bought existing houses and 88% view homeownership as their best investment.

Peter H. Miller, Hon. AIA, is the publisher and President of TRADITIONAL BUILDING, PERIOD HOMES and the Traditional Building Conference Series, and podcast host for Building Tradition, Active Interest Media's business to business media platform. AIM also publishes OLD HOUSE JOURNAL; NEW OLD HOUSE; FINE HOMEBUILDING; ARTS and CRAFTS HOMES; TIMBER HOME LIVING; ARTISAN HOMES; FINE GARDENING and HORTICULTURE. The Home Group integrated media portfolio serves over 50 million architects, builders, craftspeople, interior designers, building owners, homeowners and home buyers.

Pete lives in a classic Sears house, a Craftsman-style Four Square built in 1924, which he has lovingly restored over a period of 30 years. Resting on a bluff near the Potomac River in Washington, D.C., just four miles from the White House, Pete’s home is part of the Palisades neighborhood, which used to be a summer retreat for the District’s over-heated denizens.

Before joining Active Interest Media (AIM), Pete co-founded Restore Media in 2000 which was sold to AIM in 2012. Before this, Pete spent 17 years at trade publishing giant Hanley Wood, where he helped launch the Remodeling Show, the first trade conference and exhibition aimed at the business needs and interests of professional remodeling contractors. He was also publisher of Hanley Wood’s Remodeling, Custom Home, and Kitchen and Bath Showroom magazines and was the creator of Remodeling’s Big 50 Conference (now called the Leadership Conference).

Pete participates actively with the American Institute of Architects’ Historic Resources Committee and also serves as President of the Washington Mid Atlantic Chapter of the Institute of Classical Architecture & Art. He is a long-time member of the National Trust for Historic Preservation and an enthusiastic advocate for urbanism, the revitalization of historic neighborhoods and the benefits of sustainability, including the adaptive reuse of historic buildings.