Peter Miller

The Housing Market: The Road Ahead

For a recent, comprehensive housing market forecast presented by Robert Dietz, Chief economist for the NAHB, click here. It is a webinar with audio, including informative slides, with insight on macroeconomics, material prices, regional housing starts and predictions for interest rates through 2020.

Some of the highlights and risks ahead: Remodeling market growth, 9% year over year, will outpace new construction growth. Single family housing starts are a projected 900,000 units this year, 20% of which are custom homes. As Gen Xers enter the market, followed closely by older millennials, town house construction will grow its share of the total housing market from 12% to 15%. Multi housing will peak at 390,000 units. Interest raises will rise with inflationary pressure.

New house affordability is still a challenge for first time buyers which bodes well for the sale of existing homes. An overall shortage of houses for sale will push the afore mentioned growth of the remodeling market. NAHB’s remodeling market forecast is likely conservative.

I told you so. In a previous blog, I wrote that the high cost of new construction, the aging housing stock and huge demand for home ownership among 30 somethings would bode well for old house remodeling, especially since these old houses are in cities and close- in walkable neighborhoods.

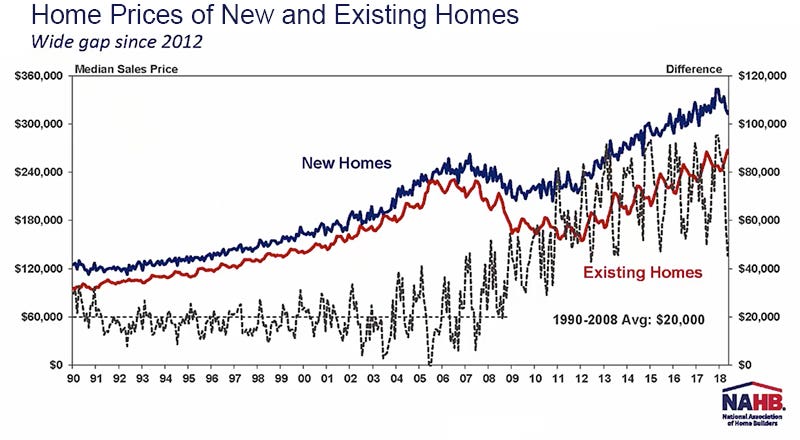

NAHB’s analysis also shows that the price of a new house is $20,000- $100,000 more expensive than an existing house. The fixer upper house, whose new owner can make improvements over time, some of it D-I-Y improvements, is a good start for the first-time buyer. It used to be that 78% of median income home buyers could afford homeownership. Now that number is 67%. This accounts for the drop in overall home ownership and the increase of renters. But this is shifting back again: home ownership is rising as renters become owners. The move up housing type of choice, for renters who want to own, is fee simple townhouses.

Kids living with their parents, a phenomenon widely reported, continues its trend. Now 20% of 20 somethings still live at home compared to 12% twenty years ago. Group housing is more common whether its elderly parents moving in with their grown-up children; single people co- habitating or kids living in their parent’s basement.

Building material prices, like lumber, gypsum, aluminum and steel, are on the rise, in part because of tariffs and because of material shortages. Inflation in building material prices contributes to overall inflation which will cause the Federal Reserve to raise interest rates twice in 2019 to hit 5% by 2020.

Builder confidence and consumer confidence is at a twenty-year high. After several post-recession years of income stagflation, wages and disposable income are on the rise. Nevertheless 60% of home buyers surveyed are “dissatisfied” with what is available for the price. The new houses they see do not look like a good value.

More reason for us to build good-value houses which meet the market’s needs and to position ourselves for serving the robust remodeling market.

Peter H. Miller, Hon. AIA, is the publisher and President of TRADITIONAL BUILDING, PERIOD HOMES and the Traditional Building Conference Series, and podcast host for Building Tradition, Active Interest Media's business to business media platform. AIM also publishes OLD HOUSE JOURNAL; NEW OLD HOUSE; FINE HOMEBUILDING; ARTS and CRAFTS HOMES; TIMBER HOME LIVING; ARTISAN HOMES; FINE GARDENING and HORTICULTURE. The Home Group integrated media portfolio serves over 50 million architects, builders, craftspeople, interior designers, building owners, homeowners and home buyers.

Pete lives in a classic Sears house, a Craftsman-style Four Square built in 1924, which he has lovingly restored over a period of 30 years. Resting on a bluff near the Potomac River in Washington, D.C., just four miles from the White House, Pete’s home is part of the Palisades neighborhood, which used to be a summer retreat for the District’s over-heated denizens.

Before joining Active Interest Media (AIM), Pete co-founded Restore Media in 2000 which was sold to AIM in 2012. Before this, Pete spent 17 years at trade publishing giant Hanley Wood, where he helped launch the Remodeling Show, the first trade conference and exhibition aimed at the business needs and interests of professional remodeling contractors. He was also publisher of Hanley Wood’s Remodeling, Custom Home, and Kitchen and Bath Showroom magazines and was the creator of Remodeling’s Big 50 Conference (now called the Leadership Conference).

Pete participates actively with the American Institute of Architects’ Historic Resources Committee and also serves as President of the Washington Mid Atlantic Chapter of the Institute of Classical Architecture & Art. He is a long-time member of the National Trust for Historic Preservation and an enthusiastic advocate for urbanism, the revitalization of historic neighborhoods and the benefits of sustainability, including the adaptive reuse of historic buildings.