Peter Miller

A Look At the 2017-2018 Housing Market

PRE-OWNED HOUSES, the realtor's euphemism for "the house needs work," are selling briskly, when available. Sales of pre-owned homes are up again this month, but the inventory of these homes for sale is down vs. a year ago from 2 million to 1.8 million. The median price of a pre-owned single-family house is now $248,000, up for the 68th straight month, according to the National Association of Realtors. The current supply of old house inventory is 3.9 months, down from 4.4 months.

How does it compare?

This compares to a new house inventory supply of 4.9 months. The median price of a new single-family home is up again to $312,000 October was a good month for new house sales, the best month since October 2007. Quoting a Bloomberg Markets headline, "U.S. New-Home Sales Unexpectedly Rise to Highest in a Decade," single-family home sales rose 6.2%, a 685,000-annual pace. New home purchases in the South rose for the third month in a row, the fastest pace in 10 years, despite the hurricanes.

There was a new home sales "surge" of 17% in the Mid-West market, according to Bloomberg. Big houses are selling best, across the country, a data point revealed in our own Home Group research as well as in the NAHB's housing analysis.

First time home buyers accounted for 32% of the pre-owned home sales in October according to the NAR. Boston and San Francisco lead the country in housing sales, likely driven by tech job growth for millennials. All cash sales account for 20% of the sales, driven largely by investor purchasing.

These are the housing stats, based on reports from both the National Association of Realtors and the National Association of Home Builders.

Now for my commentary...

Demand is out pacing supply. Everywhere you look in our industry, there is a shortage: available new houses on the market, or pre-owned houses, or construction labor and materials. We have a supply and demand imbalance. Remember, there are 84 million millennials knocking on our industry's front door, wanting to get into a house. This is the largest population cohort in history! Just like their parents, they want to live the American dream.

The "cost of regulations," according to NAHB, accounts for 29% of a new house's total price. This is making new houses more expensive, pricing them beyond reach for many buyers. The housing market today is schizophrenic: young, and many older buyers want small and affordable, but builders and suppliers can only make money building big houses. Therefore, single family houses are getting bigger while buyers sit on the sidelines. It is a supply-side market, despite very strong demand.

The realtor's axiom "location, location, location" plus favorable demographics for pre-owned home demand will drive the remodeling market faster and higher than new construction, in the future. This is my prediction. Big and expensive new houses in exurbia are not trending. What many buyers want, and can afford, are the fixer uppers near cities, with public transportation and cultural amenities.

There are 1.8 million pre-owned houses, 30% of them "old houses." These houses "need work." The "work" will be done more effectively, attractively and authentically by people who read my magazines.

That's my story and I'm sticking to it.

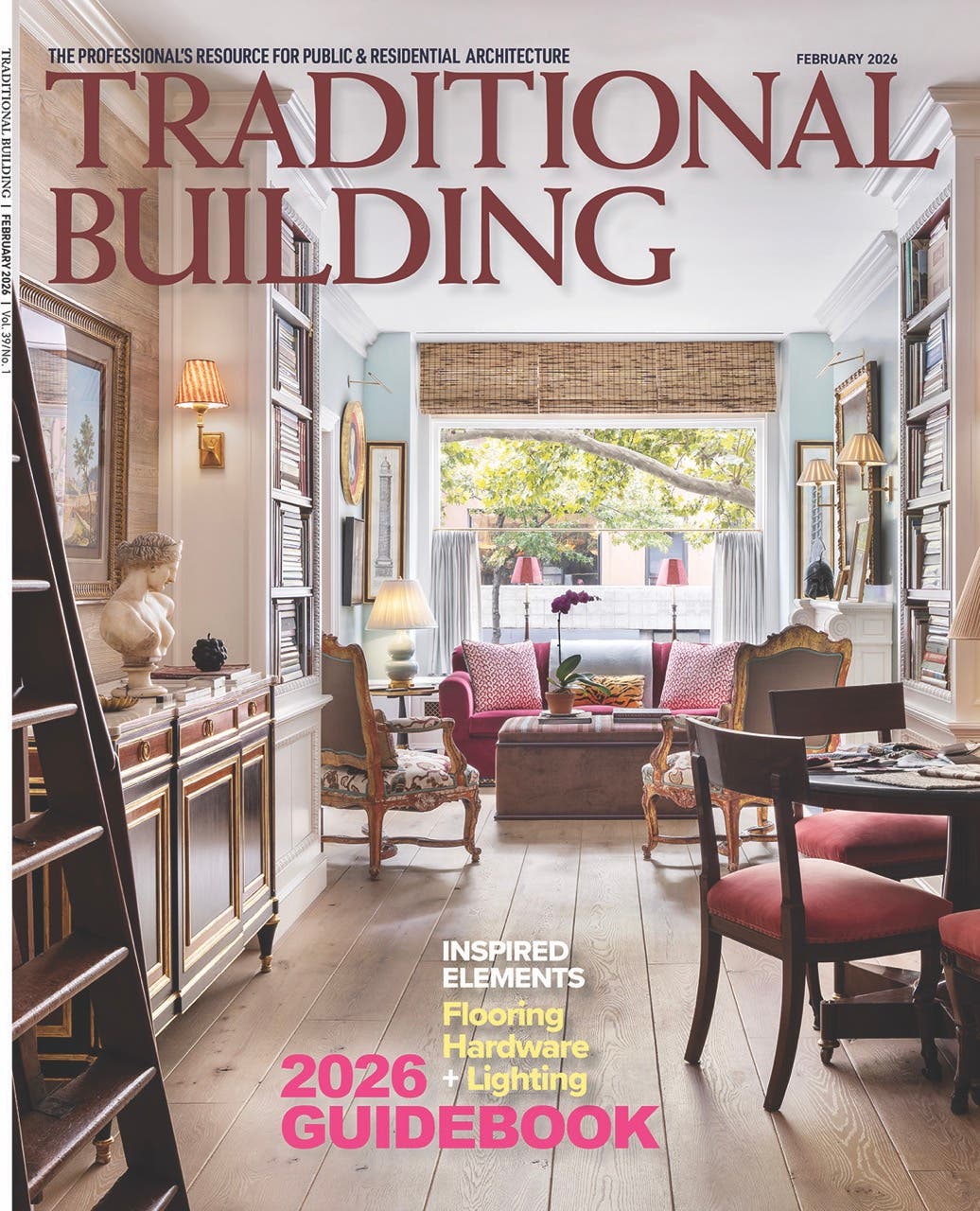

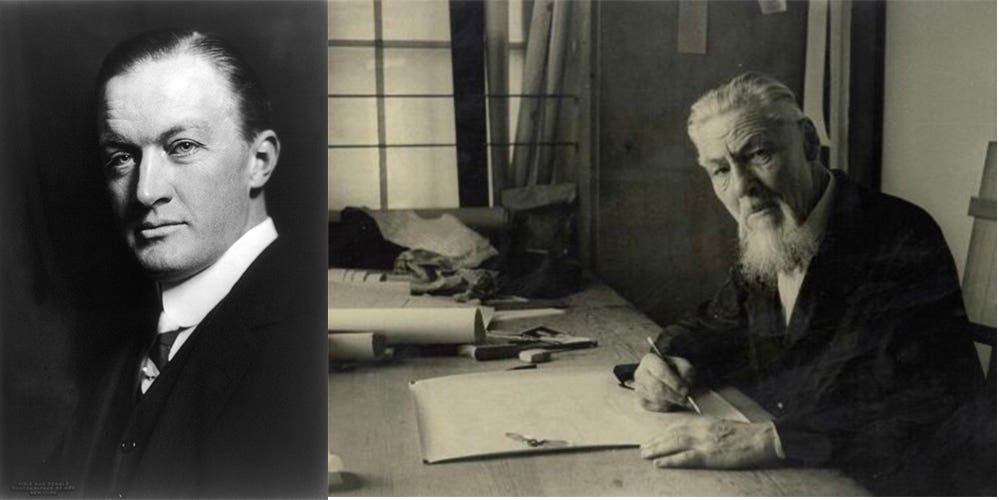

Peter H. Miller, Hon. AIA, is the publisher and President of TRADITIONAL BUILDING, PERIOD HOMES and the Traditional Building Conference Series, and podcast host for Building Tradition, Active Interest Media's business to business media platform. AIM also publishes OLD HOUSE JOURNAL; NEW OLD HOUSE; FINE HOMEBUILDING; ARTS and CRAFTS HOMES; TIMBER HOME LIVING; ARTISAN HOMES; FINE GARDENING and HORTICULTURE. The Home Group integrated media portfolio serves over 50 million architects, builders, craftspeople, interior designers, building owners, homeowners and home buyers.

Pete lives in a classic Sears house, a Craftsman-style Four Square built in 1924, which he has lovingly restored over a period of 30 years. Resting on a bluff near the Potomac River in Washington, D.C., just four miles from the White House, Pete’s home is part of the Palisades neighborhood, which used to be a summer retreat for the District’s over-heated denizens.

Before joining Active Interest Media (AIM), Pete co-founded Restore Media in 2000 which was sold to AIM in 2012. Before this, Pete spent 17 years at trade publishing giant Hanley Wood, where he helped launch the Remodeling Show, the first trade conference and exhibition aimed at the business needs and interests of professional remodeling contractors. He was also publisher of Hanley Wood’s Remodeling, Custom Home, and Kitchen and Bath Showroom magazines and was the creator of Remodeling’s Big 50 Conference (now called the Leadership Conference).

Pete participates actively with the American Institute of Architects’ Historic Resources Committee and also serves as President of the Washington Mid Atlantic Chapter of the Institute of Classical Architecture & Art. He is a long-time member of the National Trust for Historic Preservation and an enthusiastic advocate for urbanism, the revitalization of historic neighborhoods and the benefits of sustainability, including the adaptive reuse of historic buildings.

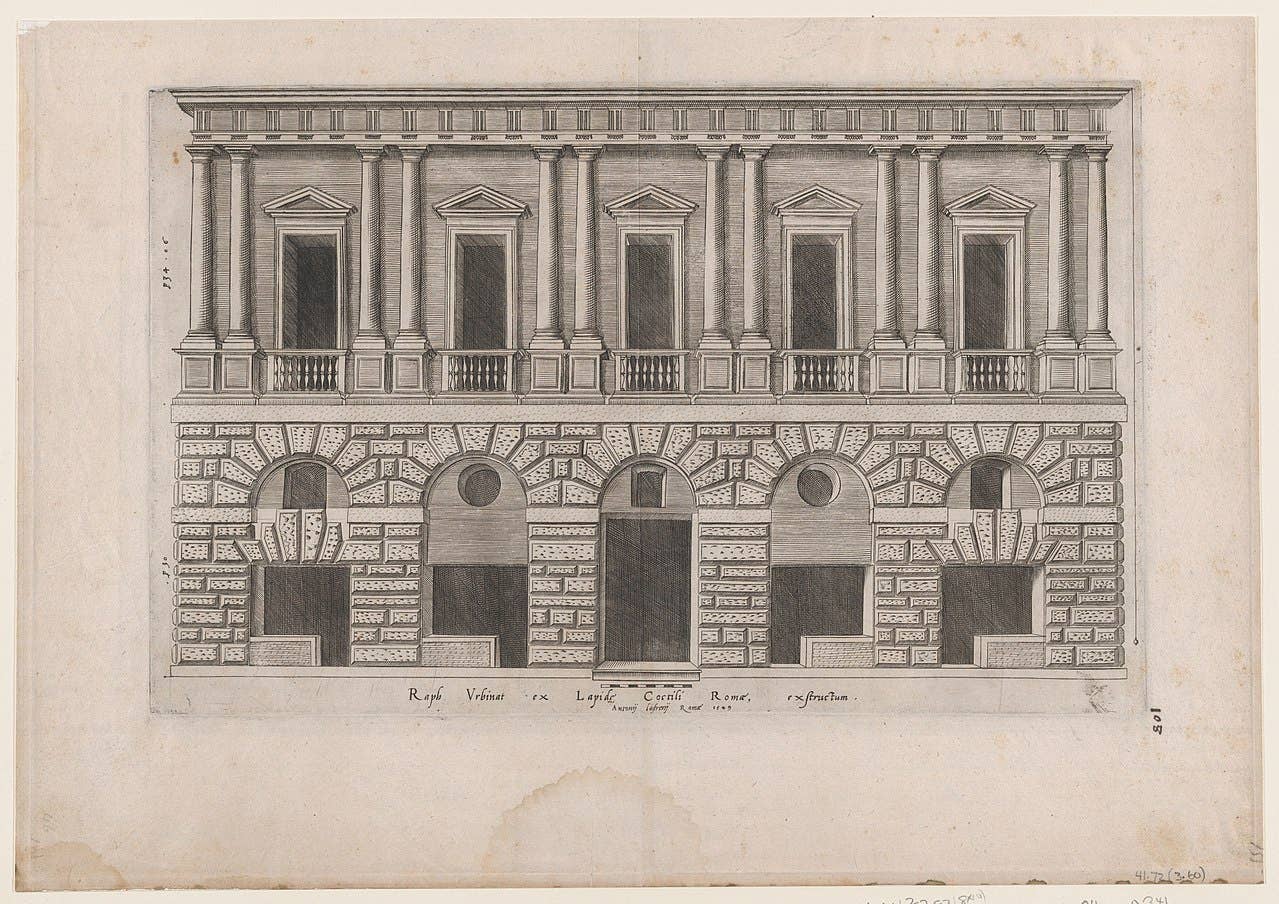

Custom fabricator & installer of architectural cladding systems: columns, capitals, balustrades, commercial building façades & storefronts; natural stone, tile & terra cotta; commercial, institutional & religious buildings.