Peter Miller

This Bubble is Different

According to a recent WALL STREET JOURNAL article, the residential real-estate market is having its best year since 2016. It’s a housing boom “ignited by the pandemic.”

Builders, architects and their suppliers are very busy, with 12-18 months of new work in their pipeline, but nervous that we’re in another housing bubble which will burst. Our memory of the last great recession remains vivid. The rising cost of building materials, supply chain disruption and a shortage of labor adds to our angst.

But low interest rates, new younger buyers entering the market and a rethink about the importance of home, are all contributing to a healthy market.

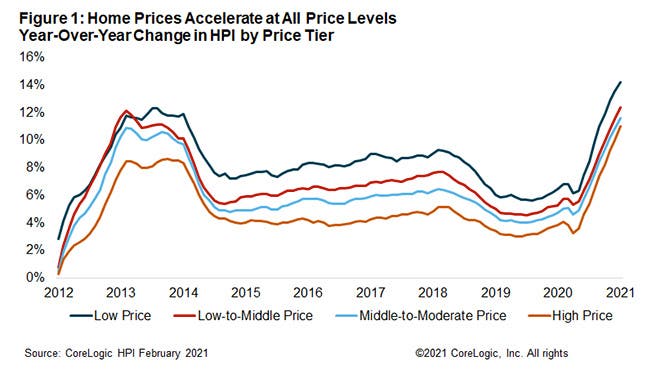

What’s different about this housing “bubble?” According to the WSJ “mortgages are stricter, down payments higher and a tight housing supply is supporting higher prices.” The National Association of Realtors pegs the median price of a new single-family home at $346,000 and going up. “The current housing boom is far more stable than the last one and poses fewer systemic risks.”

People who already own homes gained a collective $1.5 trillion in equity in 2020, according to CoreLogic. Nearly one in four home buyers paid $500,000 or more for a house between April and June 2020. Homeownership rose from 63.7% in 2016 to 65.8% in the fourth quarter 2020. Most home buyers lately, have credit scores of 720 or better.

Peter H. Miller, Hon. AIA, is the publisher and President of TRADITIONAL BUILDING, PERIOD HOMES and the Traditional Building Conference Series, and podcast host for Building Tradition, Active Interest Media's business to business media platform. AIM also publishes OLD HOUSE JOURNAL; NEW OLD HOUSE; FINE HOMEBUILDING; ARTS and CRAFTS HOMES; TIMBER HOME LIVING; ARTISAN HOMES; FINE GARDENING and HORTICULTURE. The Home Group integrated media portfolio serves over 50 million architects, builders, craftspeople, interior designers, building owners, homeowners and home buyers.

Pete lives in a classic Sears house, a Craftsman-style Four Square built in 1924, which he has lovingly restored over a period of 30 years. Resting on a bluff near the Potomac River in Washington, D.C., just four miles from the White House, Pete’s home is part of the Palisades neighborhood, which used to be a summer retreat for the District’s over-heated denizens.

Before joining Active Interest Media (AIM), Pete co-founded Restore Media in 2000 which was sold to AIM in 2012. Before this, Pete spent 17 years at trade publishing giant Hanley Wood, where he helped launch the Remodeling Show, the first trade conference and exhibition aimed at the business needs and interests of professional remodeling contractors. He was also publisher of Hanley Wood’s Remodeling, Custom Home, and Kitchen and Bath Showroom magazines and was the creator of Remodeling’s Big 50 Conference (now called the Leadership Conference).

Pete participates actively with the American Institute of Architects’ Historic Resources Committee and also serves as President of the Washington Mid Atlantic Chapter of the Institute of Classical Architecture & Art. He is a long-time member of the National Trust for Historic Preservation and an enthusiastic advocate for urbanism, the revitalization of historic neighborhoods and the benefits of sustainability, including the adaptive reuse of historic buildings.