Peter Miller

The Historic Tax Credit for Rehabilitating Historic Buildings

A story in the April issue of TRADITIONAL BUILDING discusses how the new tax laws will affect our Federal Historic Tax Credit Program. Some things will change, hopefully for the better. The good news is: the preservation tax credit was preserved.

The Historic Tax Credit provides a 20% Federal tax credit to property owners who undertake substantial rehabilitation of a historic building in a business or income producing use, while maintaining the building's historic character.

A historic schoolhouse adapted to apartments; a mill building turned into a boutique hotel or an old bank adapted for a retail store might all qualify, if the building owner follows the tax credit guidelines.

This Federal Historic Preservation Tax Incentive Program is administered by the Department of Interior's National Park Service in partnership with the State Historic Preservation Offices. The program marked it's 40th anniversary last year. Enacted in 1976, the Federal Historic Preservation Tax Incentive Program has been the stimulus for 43,000 completed rehab projects totaling $89.97 billion in private investment. To see the full report, click here.

In 2017, there was $5,823,202,692 worth of "qualified rehabilitation expenditures" for 1,035 individual historic preservation projects. This included 12,102 new and 7,096 rehabbed housing units. New York; Ohio; Massachusetts; Illinois and Louisiana, the top five states for tax credit activity, accounted for over $2.5 billion of the total $5.8 billion.

According to the National Park Service, half of the certified projects in 2017 were under $1 million in qualified rehabilitation expenditures. Twenty-seven percent were projects between $1 million and $5 million. Nineteen percent were between $5 million and $25 million. Four per cent were projects over $25 million.

Over a 40 year period, Federal Tax Incentives for Rehabilitating Historic Buildings have helped accomplish:

- 278,270 rehabilitated housing units

- 289,933 new housing units

- Added an estimated 2.54 million jobs

The first ever Federal Historic Tax Project certified rehab project was the Hiram Sibley House in Rochester New York. Since then, the program has spurred the rehabilitation of period buildings of all types including abandoned schools; churches, factories, barns and theaters. In 2017 the Buffalo State Asylum for the insane was converted to the Henry Hotel Urban Resort and Conference Center.

The Henry Hotel is a campus of buildings, designed by Henry Hobson Richardson in 1872. These building sat vacant for 40 years before preservationists saved it with help from Governor Pataki and the Federal Historic Tax Credit Program.

Another tax credit project completed in 2017 was the Houma Louisiana Elementary School which was converted into apartments. Renaissance Neighborhood Development Corp. was selected to rehab the property into mixed income housing for seniors. This $20-million, 103-unit rehab project tucked 47 apartments into the original building and 57 more in a newly built building on the back of the property.

The adaptive use Houma Elementary School is now named Academy Place. Per National Park Service guidelines, original millwork was restored including nine-over-two windows, transoms, wood floors, wainscot and trim. The original mature oak trees were saved too.

Another Tax Credit project completed last year was the Trefethen Winery in Napa California which had been badly damaged in the earthquake of August 2014. Here, a 131 –year-old barn was buckled by the tremor and nearly collapsed. Most thought the winery barn rehab was a lost cause, too expensive. "Any sane person would have knocked it down and rebuilt something new," was the prevailing sentiment. But the owners, the Trefethan family, who considered themselves the stewards of this Hamden McIntyre designed building, applied for the Federal and State Historic Tax Credits which made the project financially viable.

The winery barn first had to be stabilized, after the earthquake, using a system of jacks to balance the weight of the building. A row of diagonal steel beams formed a brace to prevent the barn from falling over. The rehab included new wood to reinforce existing walls and a series of permanent steel columns and beams...to brace it against future California earthquakes. A new HVAC system was installed. The first floor was renovated to include a wine barrel room, visible through a glass enclosure. The historic fabric was preserved. The Trefethan Winery is on the National Register of Historic Places.

There are three steps a building owner must take to qualify for the Federal Historic Tax Credit:

- Part 1. Submit an application to the National Park Service which determines if the building is a "certified historic structure" and therefor eligible for the Tax Incentive Program.

- Part 2. Is the NPS preliminary approval based on a description of the rehab work to be done, including plans and specifications. This narrative must demonstrate adherence to the Secretary of Interior (NPS) Standards for Rehabilitation

- Part 3. Is a determination that the completed project preserves the historic character of the property, meets NPS guidelines and is a "certified rehabilitation" for the purposes of claiming the Federal Historic Tax Credit

In 2017, 1,652 projects were submitted for step one. Projects which ultimately got "certifications for completed work," part 3, numbered 1,035.

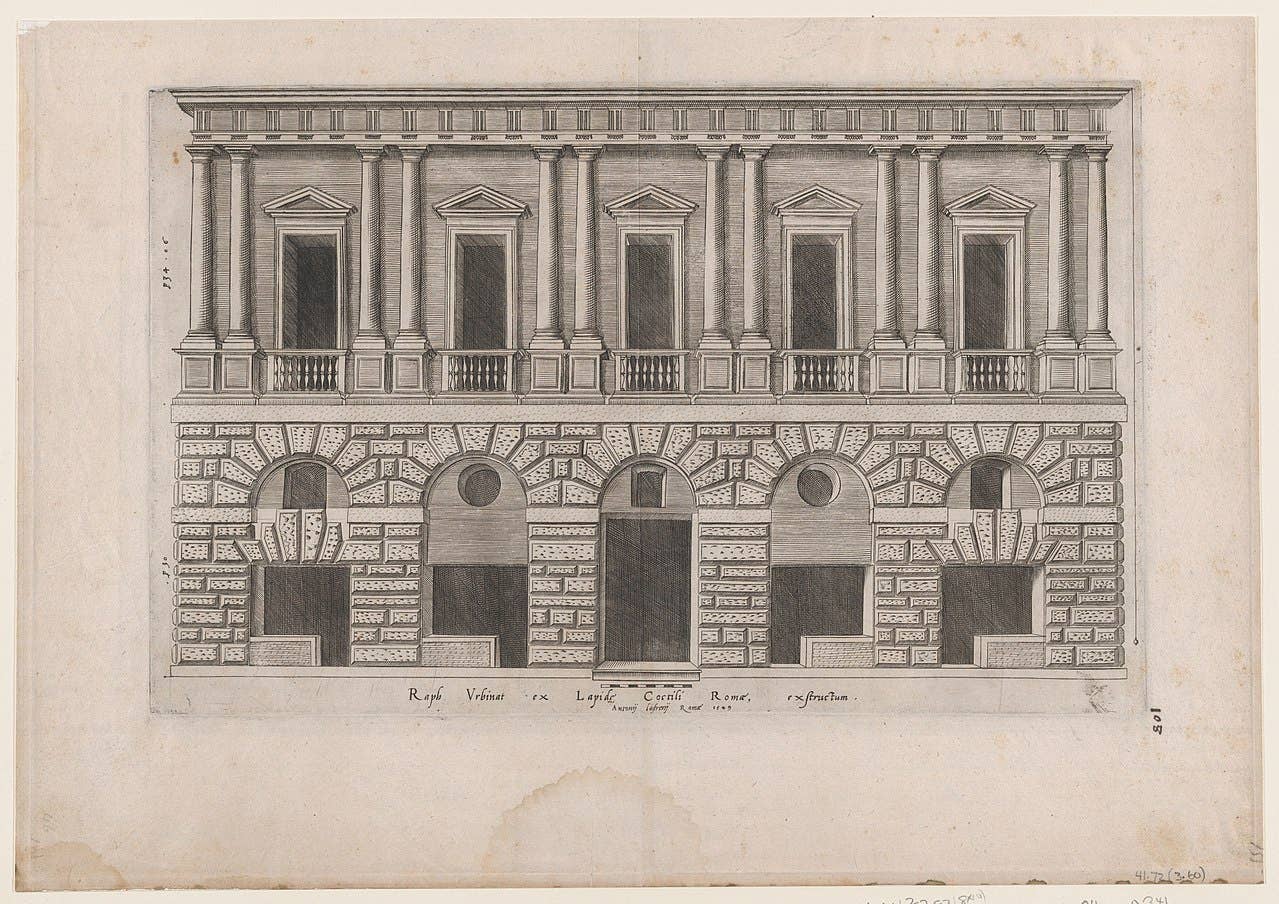

Not every architect, building owner, contractor or materials supplier who works in the $170-billion* traditional building market does preservation tax credit work. But with or without tax incentives, everyone should understand the Department of Interior's (NPS) guidelines and strive to preserve the character defining historic elements which make the building unique.

*my educated estimate

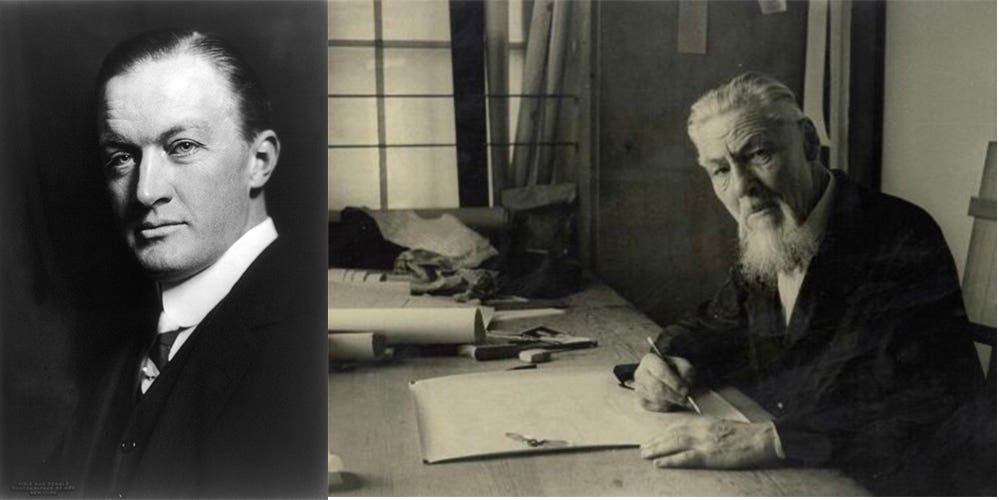

Peter H. Miller, Hon. AIA, is the publisher and President of TRADITIONAL BUILDING, PERIOD HOMES and the Traditional Building Conference Series, and podcast host for Building Tradition, Active Interest Media's business to business media platform. AIM also publishes OLD HOUSE JOURNAL; NEW OLD HOUSE; FINE HOMEBUILDING; ARTS and CRAFTS HOMES; TIMBER HOME LIVING; ARTISAN HOMES; FINE GARDENING and HORTICULTURE. The Home Group integrated media portfolio serves over 50 million architects, builders, craftspeople, interior designers, building owners, homeowners and home buyers.

Pete lives in a classic Sears house, a Craftsman-style Four Square built in 1924, which he has lovingly restored over a period of 30 years. Resting on a bluff near the Potomac River in Washington, D.C., just four miles from the White House, Pete’s home is part of the Palisades neighborhood, which used to be a summer retreat for the District’s over-heated denizens.

Before joining Active Interest Media (AIM), Pete co-founded Restore Media in 2000 which was sold to AIM in 2012. Before this, Pete spent 17 years at trade publishing giant Hanley Wood, where he helped launch the Remodeling Show, the first trade conference and exhibition aimed at the business needs and interests of professional remodeling contractors. He was also publisher of Hanley Wood’s Remodeling, Custom Home, and Kitchen and Bath Showroom magazines and was the creator of Remodeling’s Big 50 Conference (now called the Leadership Conference).

Pete participates actively with the American Institute of Architects’ Historic Resources Committee and also serves as President of the Washington Mid Atlantic Chapter of the Institute of Classical Architecture & Art. He is a long-time member of the National Trust for Historic Preservation and an enthusiastic advocate for urbanism, the revitalization of historic neighborhoods and the benefits of sustainability, including the adaptive reuse of historic buildings.

Custom fabricator & installer of architectural cladding systems: columns, capitals, balustrades, commercial building façades & storefronts; natural stone, tile & terra cotta; commercial, institutional & religious buildings.