“The State of Things”

I have been asking my industry friends to tell me about “the state of things” in their businesses or their practices. A new, younger generation coming along, and new consumer behaviors shaped by the great recession, will require new ways of doing things. I’ve been wondering if our industry will ever see its peak level of 2005, when housing starts were 1.7 million and nonresidential construction was strong.

Business is better for most of us, but it feels different from before. Eighty-three million millennials have yet to open the floodgates; “must-have” demand has not kicked in. The market is still largely driven by discretionary, more purposeful spending, by people who choose to spend but don’t have to. One bad headline about a foreign economic crisis or a government shutdown puts people on hold. The economy has tidal pools but no waves. There’s not much consistency or predictability.

“Our clients are much more demanding,” is the common refrain among the architects, builders, and suppliers I query. Enabled by an eight-lane information highway, consumers are better informed and more involved in the design and building process. They are “self-assured” in their acquired knowledge. They are also distractible, very busy, “too wired,” given to fits and starts, and often overwhelmed by their own desire for unlimited choices. They are cost/value conscious, as always, and often expect recession-era deals. They would rather be listened to than sold to; they are used to having it their way.

“There is little regard for lead times,” one supplier told me. “People delay and delay their decisions, finally make up their minds, then want delivery yesterday!” Another source told me, “Our clients want me to ‘make it easy’ for them.” Long gone are the clients who make it easy for us.

The only thing worse than making something we can’t sell, is selling something we can’t make

For the first time since the “peak” in 2005, demand is out-pacing supply. Some raw material prices are going up, skilled construction labor is precious, and business is scrambling to hire additional craftspeople, staff architects, sub-contractors, and salespeople. Our industry’s footprint shrank in the great recession, but now it has to grow. And there are growing pains. This supply-and-demand balancing act is what keeps us awake at night, both because we are doing more with less, and because we’re worried we can’t fully capitalize on the demand before it evaporates with the next downturn.

My sources tell me they are making more things, to provide clients with more options. “We have had to expand our product portfolio,” is something I hear a lot. Often this means serving new markets as well: Whole-house architects are designing powder rooms; classicists are morphing to modern; diversification flows from residential to institutional and commercial. Offering more may capture more sales, but not necessarily better profits. But revenue helps cash flow—and everyone winces with memories of 2009. Doing more is certainly important in the media business, where, to serve the information needs of readers, we must create and deliver content via more channels: print, digital, video, and social media, and webinars and conferences.

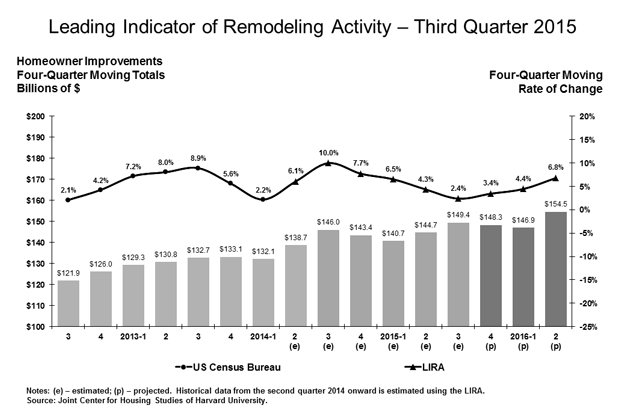

It seems there’s a lot riding on Q4 this year. Bad weather started 2015 off slowly, but we’ve gathered momentum as the year progresses. Finishing strong is critical to success in 2015. The World Series champion Kansas City Royals’ ability to “keep the ball in play and come from behind” is an apt metaphor for running a business now.

“Business will be up in 2016,” say the pundits; by how much, depends. Driving growth will be new product introductions, additional salespeople, greater capacity, job growth, and real-estate appreciation. Uncertainty around elections and world events will not drive growth. Still, economic forecasts are good enough.

We feel good enough, too—lucky, even. Relieved! Let’s remember to celebrate the small victories.

Peter H. Miller, Hon. AIA, is the publisher and President of TRADITIONAL BUILDING, PERIOD HOMES and the Traditional Building Conference Series, and podcast host for Building Tradition, Active Interest Media's business to business media platform. AIM also publishes OLD HOUSE JOURNAL; NEW OLD HOUSE; FINE HOMEBUILDING; ARTS and CRAFTS HOMES; TIMBER HOME LIVING; ARTISAN HOMES; FINE GARDENING and HORTICULTURE. The Home Group integrated media portfolio serves over 50 million architects, builders, craftspeople, interior designers, building owners, homeowners and home buyers.

Pete lives in a classic Sears house, a Craftsman-style Four Square built in 1924, which he has lovingly restored over a period of 30 years. Resting on a bluff near the Potomac River in Washington, D.C., just four miles from the White House, Pete’s home is part of the Palisades neighborhood, which used to be a summer retreat for the District’s over-heated denizens.

Before joining Active Interest Media (AIM), Pete co-founded Restore Media in 2000 which was sold to AIM in 2012. Before this, Pete spent 17 years at trade publishing giant Hanley Wood, where he helped launch the Remodeling Show, the first trade conference and exhibition aimed at the business needs and interests of professional remodeling contractors. He was also publisher of Hanley Wood’s Remodeling, Custom Home, and Kitchen and Bath Showroom magazines and was the creator of Remodeling’s Big 50 Conference (now called the Leadership Conference).

Pete participates actively with the American Institute of Architects’ Historic Resources Committee and also serves as President of the Washington Mid Atlantic Chapter of the Institute of Classical Architecture & Art. He is a long-time member of the National Trust for Historic Preservation and an enthusiastic advocate for urbanism, the revitalization of historic neighborhoods and the benefits of sustainability, including the adaptive reuse of historic buildings.